What to Look for When Buying a Home

Make sure you find the best home for the best price with this complete guide to house hunting.

Make sure you find the best home for the best price with this complete guide to house hunting.

House hunting is a marathon and not a sprint. Suppose you rush into buying your home. You may be overwhelmed with emotion or just plain desperate. Although there are times to act quickly, you risk making a mistake that could cost more than money and time. You could jeopardize your family’s future.

Too many homeowners have horror stories about homes that are sinking into the earth and are quickly draining their savings. Some homeowners move in unaware that their neighbors are planning a war, and before they know it, they’re locked in an emotionally taxing battle of the yard signs.

With you and your family’s happiness on the line, you need to make an educated decision. You should do your best to figure out precisely what you want before you start home shopping. Talk to your realtor, and ask them every burning question you can think of. Find out about the land parcel and whether an area is safe or not. Then you can do a little research on your own, and use this guide to help you finalize what you want.

In general, there are nine essential features you must consider when moving into your home.

You shouldn’t look at houses outside of your price range. If you do, you could end up in love with a home you can’t afford or become house poor, which means your house payment will consume most of your expendable income.

If you are unsure about whether or not you can afford a home, it’s a good idea to employ the 50/30/20 rule and use a mortgage calculator.

The 50/30/20 rule is the recommendation that you spend around 50% of your monthly income on needs; these can include housing, food, transportation, and other necessities. The additional 30% you are allowed to spend on your wants, which can consist of nights out or shopping trips. Finally, you put around 20% in your savings. With this framework, you can create a budget with your monthly income and estimate how much you can spend on a mortgage. Then simply use our mortgage calculator to determine what monthly payments would look like on homes in different price ranges.

The average square footage of a U.S. home is over 2,000 sq ft. However, depending on your needs, you may aim for a slightly larger home. The size of the house can be one of the most critical factors for larger families who are looking to upgrade for more space.

A larger home can also mean more costly utilities, so there is a trade-off depending on where you are home shopping. Taking the square footage of houses and dividing by cost can give you a more accurate representation of the home’s price as well. You can then compare and contrast homes in different areas to get a better idea of the kind of deal you are getting.

For almost everyone, a safe neighborhood with an excellent school district is a critical factor for them. Locating reliable info about an area can be tricky. We recommend looking for information about crime using community and online resources. Area Vibes and Neighborhood Scout are great websites to start with, or you can call up the local city council to ask for more information.

Another great way to feel out a neighborhood is to drive around the area at night. Cruising through the neighborhood with your headlights on might put a spotlight on rowdy neighbors or potential problems.

Even if you don’t have a family, a good school district might not be an item you rule out right away. A 5% improvement in test scores can even raise home prices 2.5%, according to the New York Times. Not only does housing in great districts have more return potential in the long run, but it’s always good to be prepared if you decide to grow your family.

When you are shopping for homes, you also want to get the most value out of your investment. Knowing that you are moving into an area with a quality school district helps preserve this value. You also might want to consider looking at area trends to help you make a decision. If you can get an inexpensive home in a beautiful area that is considered up and coming, you will be able to maximize your equity. Make your money work for you.

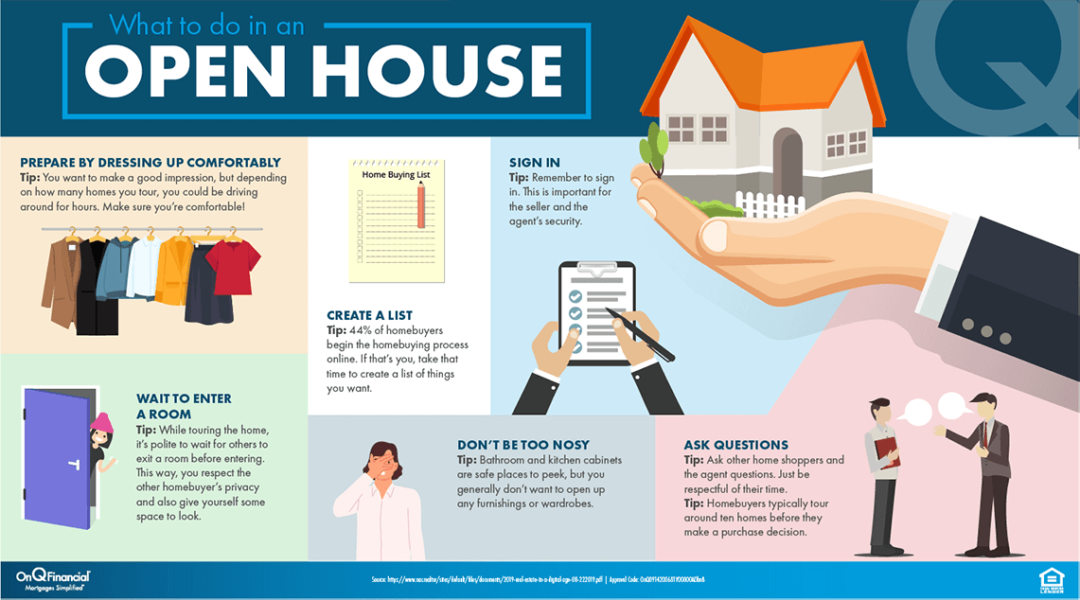

Open houses can be an invaluable resource for you. Although attending open houses may not be everyone’s favorite way to spend the weekend, taking advantage of these showings can provide valuable insight into the home and the neighborhood.

Talk to the other home shoppers when you have the chance. You can ask them where they have been looking, or find out about other homes on the market. Make the best of it. A candid conversation is one of your best opportunities to get unbiased opinions.

At open houses, you also have the opportunity to meet your potential next-door neighbor. Interested people often tour local homes to compare against their own. Don’t be afraid to ask them honest questions about the area as well. They are going to give you the best insight into living in the neighborhood, considering they’ve had the most experience.

Touring open houses is a great environment if you want to examine the home thoroughly. When you are looking through homes, it’s a good idea to be discreetly nosey. Open kitchen and bathroom cabinets and cupboards to see if you can spot mold or rot. These can be signs of foundational issues that may be expensive repairs later on. You may feel uncomfortable considering this isn’t your home, but if you are going to live there, you have a right to know.

If you want to maximize the value of your home, look for houses in a suitable area that are lower priced. As the city grows and home prices appreciate, you will gain more value over time. Pro home shoppers know long term about their financial goals, and how their home can help them grow wealth.

Consider the following questions to help you decide what kind of home you want:

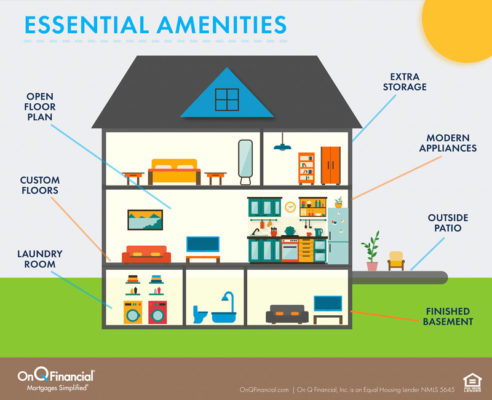

You also want to consider more than accessibility and space issues. You want to think about valuable features of the home. Custom floors, a finished basement, jacuzzi tub, or an open floor plan might all be wants, but which amenities are most important to you? What are your must-haves?

Some couples need his and her bathrooms, or they would drive each other crazy. Others need privacy or extra space to work out. It all depends on your unique situation, so consider your lifestyle and start making a list. Then run that list by your realtor and see what is doable in your price range.

You want to find the perfect home. Of course, it’s natural to be picky. Many potential homeowners can be turned off by surface issues. There are things you can easily change, such as wall color or carpet, and others that you can’t. Instead of getting caught up on ugly bathroom walls, focus on aspects of the house that you wouldn’t be able to change, such as size, layout, or area.

It’s also essential to be able to recognize what you are and are not able to accomplish by yourself when it comes to repairs. If you see something you think may be manageable, talk with your real estate agent to get a better sense of what the actual cost would be.

Thinking about the outside of your home is just as important as thinking about the inside. Do you want a swimming pool and a lot of yard space? Maybe you have young children, so you’ll need a gated pool. Are you willing to compromise because you want a home in a big city? You might have to settle for less and trade off a shorter commute. Deciding what you want your potential yard to look like all depends on what your specific needs are.

Also, consider that the bigger the yard, the more upkeep is required. Whether it’s pulling weeds or mowing grass, you could find yourself overwhelmed every weekend and have less free time for friends and family. If you don’t want every weekend consumed by lawn maintenance, you may want to consider following the less is more philosophy.

In the pandemic, many employees have discovered their commute is a stroll down the hallway. In that case, this consideration won’t be as necessary, but there are many Americans who continue their daily drive to work. In fact, according to CNBC, the average commute to work in the U.S. is around 26 minutes. Maybe a longer commute is worth more privacy and more land? Others can’t wait to move into the big city. Think about where the neighborhood is respective to your job; depending on where you work, you may want to reconsider touring that home.

How much privacy does the home genuinely have? A great way to get a feeling for the home is to act like you already live there. Imagine yourself living in the house. Stand outside and listen to the environment. If you are bothered by road noise or sirens, you may want to look for a home outside the city.

If the home is experiencing pest problems, you may want to reconsider buying the house. Pest issues can be a sign of broader foundational concerns. Not only is it annoying, but it can be costly over time.

Different regions across the country offer unique challenges when it comes to pest control. In the Southwest, you may be facing pest problems you’re not accustomed to. Even if it isn’t required, you should strongly consider ordering a wood-destroying insect report. Pests such as termites can live in your walls for years before it’s too late. Make sure that your home is pest-free before you move. You don’t want to find out after moving in that the neighbors you should have been worrying about were wasps or mosquitos. Spotting issues before they happen will be instrumental if you don’t want to deal with problems down the line.

Understanding local weather is a must for particular home shoppers looking to escape the cold or heat. Consider what kind of weather you prefer when you are selecting a home. Would you swap hot sweltering summers for snow in the winter? How much rain do you want to enjoy a year? You will also be considering what is best for your family and making the best choice for them, so it’s always a great idea to include them in the decision.

The sellers are legally obligated to disclose any kind of issue with the property, including pest problems, flood damage, or other issues. Ask them, if you get the chance, about the property and how the home has treated them. You should be issued disclosures around the same time that you make an offer. If you expect the seller to take your offer seriously, you need to be pre-approved.

When you make the offer, it is best to know what kind of contingencies there are and how to protect your earnest deposit. It’s a great idea to discuss this with your realtor beforehand, and also have a plan for negotiations. Continue onto our next guide, which explains everything you need to know about negotiating your costs.

For informational and educational purposes only. On Q Home Loans, is an Equal Housing Lender. NMLS #5645

Now that you know how to find your Dream Home and once you have found it, the next step is to make an offer. This part of the process is exciting and can feel a little overwhelming. To learn more about the process and some tips, continue to the next chapter of the Home Buying Journey, where you’ll learn How to Make a Purchase Offer.

Next Step: How to Make a Purchase Offer